October 2021: Dividend Portfolio Update

- Joe Shedd

- Oct 30, 2021

- 2 min read

Updated: Dec 24, 2022

TABLE OF CONTENTS

The GOAL of my dividend growth portfolio is to balance increasing share value (Growth) while simultaneously building and producing passive income (Dividends) that can be used during retirement. Currently my portfolio is concentrated more on growth with a dividend yield of 2.49%. As I near retirement I will look to produce more income and less growth. Typically, I deposit $2,000-$4,000 monthly into this portfolio, with $29,000 deposited YTD. This portfolio is in addition to my tax deferred ROTH TSP. Currently, I reinvest all dividends utilizing DRIP. As, I gain more dividends I will hand select targeted reinvestment and withdraw the correct percentage to cover anticipated taxes.

Interested in starting you own Dividend Investing journey? Check out my Ultimate Dividend Investing Guide and personal Dividend Growth Portfolio!

Monthly Performance

October was solid month for my portfolio, returning 5.82% after a -4.8% loss in September. Had I sold last month I would have locked in my loses and most likely missed out on the turn around. The large jump mid-month is my deposited funds.

My portfolio has done well this year overall when you zoom out and look at performance YTD. It has closely followed the SP500 with a +20.69% return on investment YTD compared to the SP500's 22.61%. This is the ROI if you don't include my reinvested dividends.

Portfolio Additions / Income Values

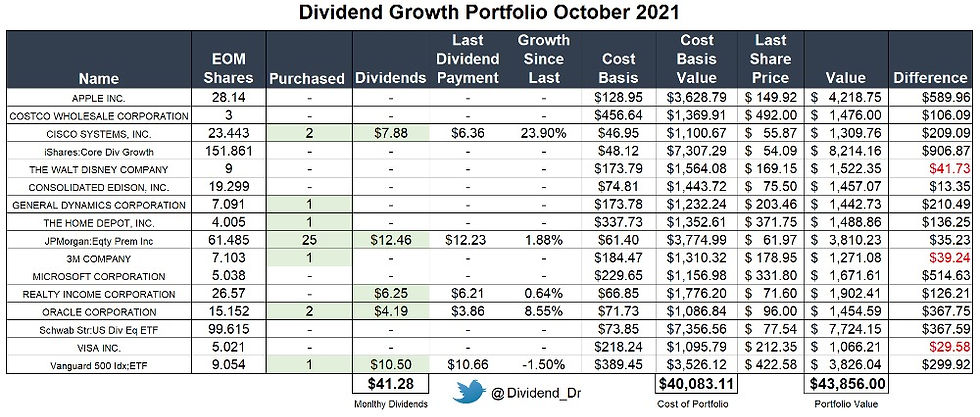

I added another $3,000 deposit in October that I used to purchase shares in Cisco, General Dynamics, Home Depot, JEPI, 3M, Oracle, and VOO. No new positions were added and all purchases went to increasing my previous holdings. These shares added another $140.88 to my annual passive income or $11.74 per month.

Overall, my portfolio is now producing $1042.46 in passive income annually or $86.87per month. Not bad for just over a year and a half of building this dividend growth portfolio. Currently, Disney is my only position that does not pay any dividends.

I received $41.28 in dividends in October this year compared to the $10.48 I earned last year. October is an off quarter month so it pays a lower amount of dividends than my quarterly payments. Overall, my dividends have grown 650.42% YTD compared to 2020.

Yearly Growth Comparisons

This is the first month of Q4 and I am already close to surpassing 2020's Q4. 2020 Q4 my portfolio made $55.52 compared to the $41.28 my portfolio earned in October alone.

My portfolio's passive income has grown significantly when compared to 2020 and represents my transition to dividend investing near the end of last year. I'm excited to see how my portfolio grows in 2022 when I compare it to 2021.

Upcoming Plans

I remain heavy in the technology sector and will continue to bring that down as Apple settles into my portfolio from a large investment earlier in the year. I will continue to selectively rebalance my portfolio by purchases shares in companies that are below my target allocation.

Comments